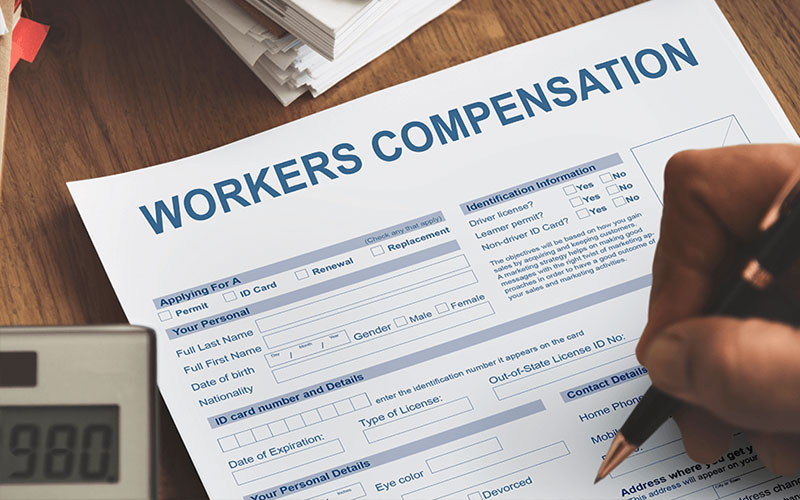

If you’re considering adding workers compensation insurance coverage to your business, you may be wondering what it does and its limits. If you are like most business owners, you likely have questions about workers’ comp coverage, but don’t worry: this article has answers to your questions. Read on to learn about the limits and types of coverage available, including Court costs, Medical expenses, and lost wages. Also, remember that workers’ compensation insurance is not a supplemental health insurance policy.

Table of Contents

Work-related injuries and illnesses

Workers’ compensation insurance benefits injured or ill employees while performing their daily duties. While heavy industry and labor-intensive jobs are most likely to suffer from workplace accidents, no worker is immune to this risk. According to the Bureau of Labor Statistics, there were 2.8 million non-fatal injuries and 5,250 fatal workplace accidents in 2018. Workplace injuries and illnesses can be devastating, resulting in extreme pain, disfigurement, and even anxiety and post-traumatic stress.

The only condition for receiving workers’ compensation is that an injury or illness must occur during the course and scope of employment. In addition, the accident must have occurred on the premises of the employer. Although it’s generally considered work-related, it’s not always easy to prove that an injury occurred while the employee was on the job. Some illnesses or injuries develop gradually over time and are not easily traceable to a particular workplace.

Court costs

Suppose you have a work-related injury and choose to use workers’ compensation insurance coverage. In that case, it is important to understand how to determine whether the coverage will cover the costs of the lawsuit. Most workers’ compensation policies cover court costs, but you should consider how much your case will cost before you sign any paperwork. Some states even allow you to file your documents online. Also, make sure to understand how much your lawyer will charge.

Medical expenses

If you have been injured on the job, you may be wondering if medical expenses covered by workers’ compensation insurance will cover the cost of treatment. However, if you don’t know what the coverage will cover, read on to find out how to maximize your benefits. Medical expenses covered by workers’ compensation insurance must cover medical treatment that is reasonable and necessary for your particular case. Your policy will cover the costs of doctor visits, surgery, medications, and other medical equipment related to your work-related injury.

Most businesses should have workers’ compensation insurance. It helps pay for costs resulting from an accident at work. This can include ambulance rides, medications, hospital stays, and ongoing medical care. For example, if an HVAC installer breaks several bones while lowering an air conditioner, his workers’ compensation insurance policy will pay for the cost of surgery, medications, and physical therapy. For some companies, this policy covers even funeral expenses and survivor benefits.

Lost wages

The workers’ compensation insurance pays out a percentage of your lost wages if your injury prevents you from working. This amount varies depending on the severity of your injury. Generally, lost wages are paid out weekly. Additionally, you may receive vocational training or counseling for a new career. Your employer cannot deny you workers’ compensation benefits based on your risk level in the workplace. However, some conditions apply.

The first criterion to determine if workers’ compensation insurance covers your lost wages is the cause of your injury. For example, if a work-related accident causes incapacitation, the insurance should cover your medical care and lost wages. This insurance kicks in only if the injury results from work-related duties. For example, suppose you suffered an injury at the workplace and could not work for several days or weeks. In that case, you may be eligible for medical care and disability income benefits.